Photograph of the Boyle-Pryor Construction Company Building near the southeastern city limits at that time.

Boyle-Pryor Construction Company

Photograph of the Boyle-Pryor Construction Company Building near the southeastern city limits at that time.

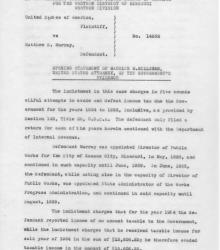

Clipping from the Kansas City Times on July 3, 1937 showing William D. Boyle of Boyle-Pryor Construction Company, Thomas J. Pendergast, and James M. Pendergast, all of whom allegedly assisted defendants in the 1936 Election Vote Fraud Trails. The caption for each photograph includes a quote from that person.

U.S. Attorney Maurice M. Milligan's opening statement in Criminal Case No. 14652: United States vs. Matthew S. Murray, defendant. Milligan notes that Murray filed tax returns in each of those years, for considerably less than his actual income, i.e.

Letter from Thomas McGee to Harry S. Truman in which McGee discloses his efforts to get Pendergast and James P. Aylward to help re-appoint his son-in-law, John Lillis, to the Federal Housing Administration. McGee says that Pendergast may seek the help of Truman and Bennett C. Clark in this matter.

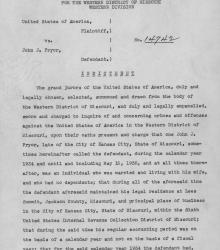

Indictment for Criminal Case No. 14742: United States vs. John J. Pryor, Defendant. In this indictment, the defendant is charged with income tax fraud for the calendar years 1934 through 1937. Pryor, co-owner of Boyle-Pryor Construction Company, reported $12,000 in gross income in 1934 while the true figure was $206,487.05.

Verdict and Commitment for Criminal Case No. 14742: United States vs. John J. Pryor, Defendant. Upon plea of guilty for three counts of income tax fraud, Pryor is sentenced to federal penitentiary for a total of two years with five years probation following. Pryor is also fined a total of $20,000.